Moneywise

7 min read

Moneywise and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Popular finance personality Suze Orman says perhaps “no decision is bigger” than deciding when to take your Social Security benefits.

Soon-to-be retirees can start receiving their benefits as early as 62 if they so choose — but Orman advises that it’s better to wait to max out your monthly checks and benefit your future older self in the long term.

-

Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don't have to deal with tenants or fix freezers. Here's how

-

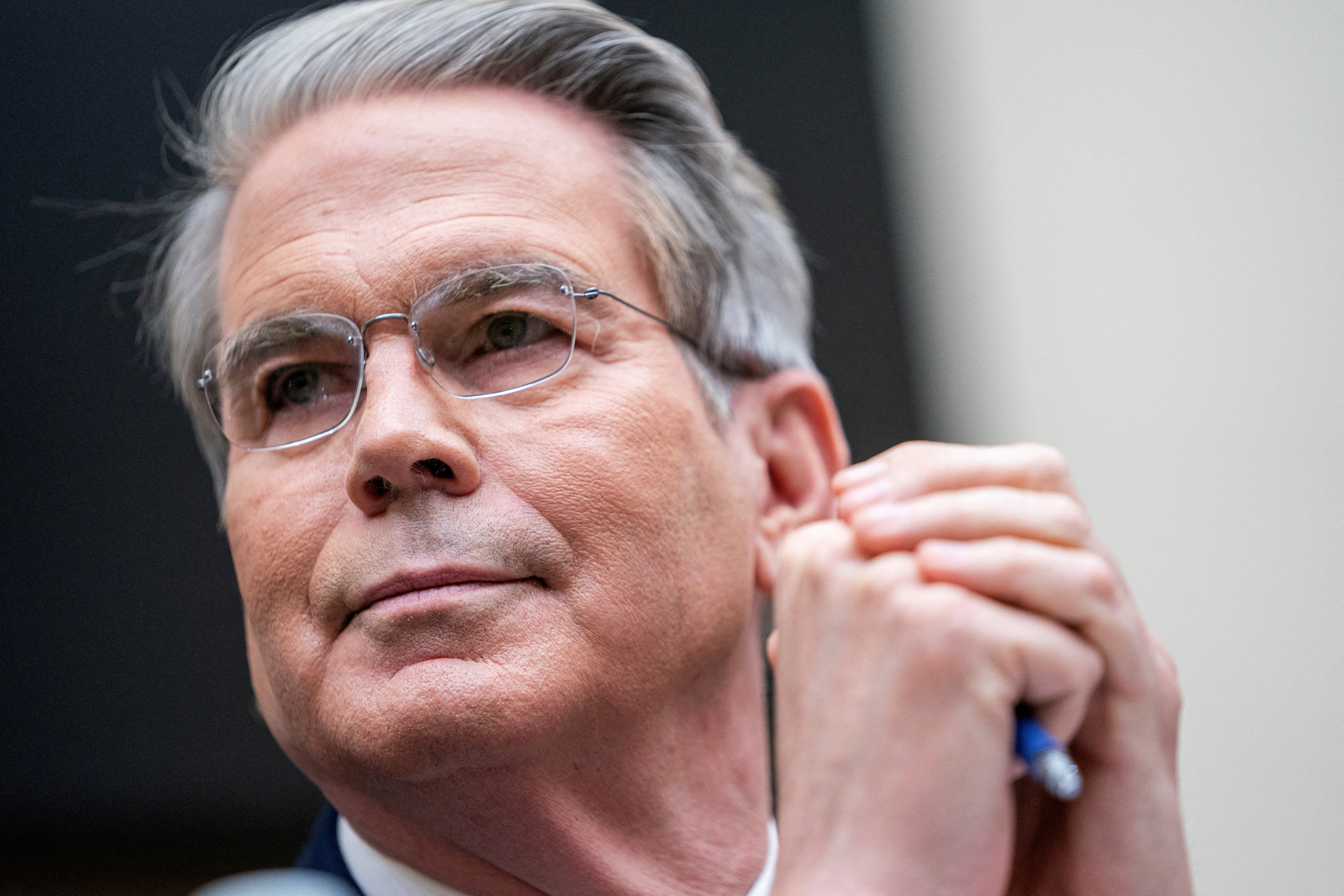

BlackRock CEO Larry Fink has an important message for the next wave of American retirees — here's how he says you can best weather the US retirement crisis

-

Nervous about the stock market in 2025? Find out how you can access this $1B private real estate fund (with as little as $10)

In a blog post titled Navigating When to Claim Social Security Orman wrote, “remember... a woman who makes it to age 65 in average health has a 50% probability of still being alive at age 88. That’s an argument for waiting if you expect to rely on Social Security for a lot of your retirement income.”

Advertisement: High Yield Savings Offers

Powered by Money.com - Yahoo may earn commission from the links above.In a related LinkedIn post, she said “I encourage you to keep returning to this thought exercise: What are the financial steps you might take today to be kindest to your future older self? The 88-year-old, the 90-year-old, the 95-year-old?”

Suze Orman regularly urges people approaching retirement to think deeply about the financial decisions that will benefit their future selves.

Here are a few of her key points to consider.

A study from life insurance company MassMutual found that 40% of Americans aged 55 to 65 believe Social Security will be their biggest source of income in retirement, ahead of 401(k) plans, investments, and pensions.

Orman explains that for every month past your 62nd birthday that you don’t claim Social Security, you’ll snag a slightly larger payout when you do start receiving your benefits.

For example, according to the Social Security Administration, folks born in 1960 or later whose full retirement age is 67 would see their benefits reduced by about 30% if they start claiming them at 62.

Extending your retirement means you have more time to contribute to your retirement accounts. And Suze Orman has long touted Roth IRAs as an optimal retirement savings vehicle. But there are other IRAs you can consider.

For instance, if you’re optimizing for stability with your investments, gold is typically more stable than stocks during economic downturns and recessions. In fact, gold has increased in value sevenfold over the last 100 years