Syeda Seirut Javed

2 min read

In This Article:

Cloudflare, Inc. (NYSE:NET) is one of the 10 tech stocks on Wall Street’s radar right now. On June 5, Oppenheimer raised its price target on Cloudflare, Inc. (NYSE:NET) from $165 to $200 and maintained an Outperform rating after discussions with Phil Winslow, the company’s VP of Strategic Finance & Investor Relations.

The firm grew more optimistic about the company’s growth prospects due to strong momentum in SASE (Secure Access Service Edge) security, boosted by Magic WAN adoption and improvements in CASB (Cloud Access Security Broker) and data loss prevention security features. The firm noted that the Worker platform’s expanding capabilities have gained more traction among developers who favor the shift-left approach.

Additionally, new AI-focused edge computing technologies like MCP and A2A, along with a new container service for AI workloads, are also some of the reasons for Oppenheimer’s positive outlook. The firm is confident that Cloudflare (NYSE:NET) will exceed expectations for 2025, accelerate revenue growth beyond 30%, and reach a $5 billion ARR by the end of 2028.

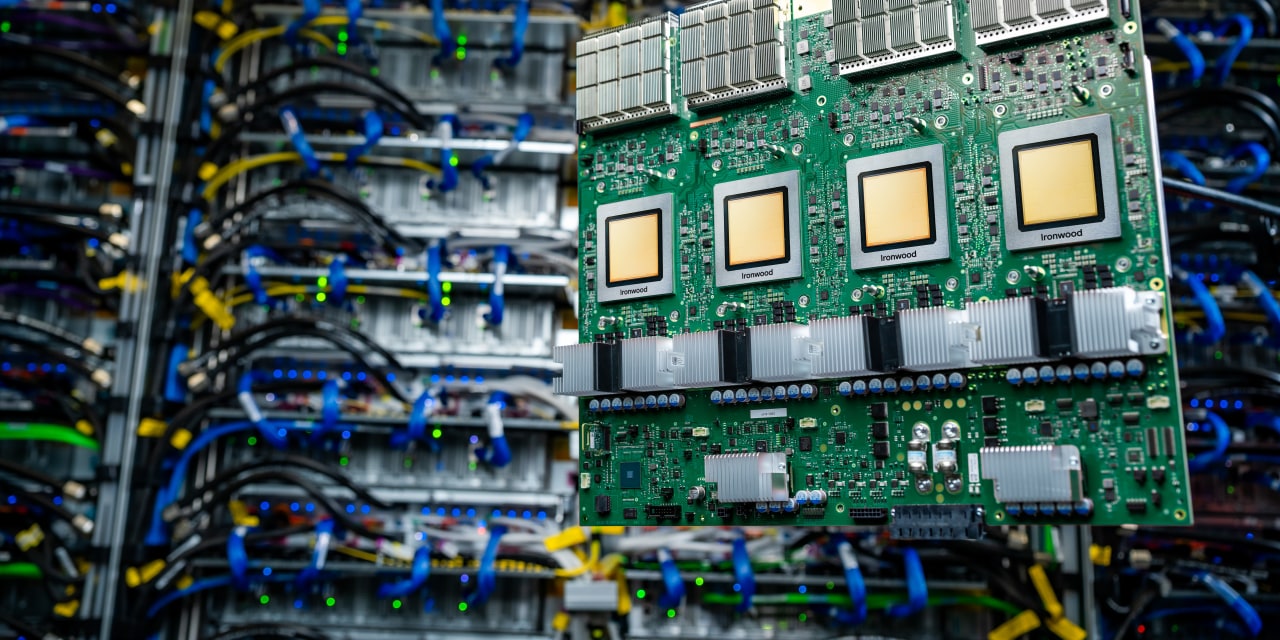

A close-up of a server array powering a cloud-services system.

Cloudflare (NYSE:NET) provides a broad suite of cloud-based security, performance, and network services designed to protect and optimize applications, websites, and data across platforms, including SaaS, IoT, and cloud environments. The company offers security solutions including zero trust and DDoS protection, network services such as Magic WAN, and developer tools alongside consumer products like VPN and DNS services.

While we acknowledge the potential of NET as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None.