Analysts issue rare warning on Nvidia stock before key earnings

AI chipmaker Nvidia (NVDA) is set to report first-quarter earnings on Wednesday, May 28.

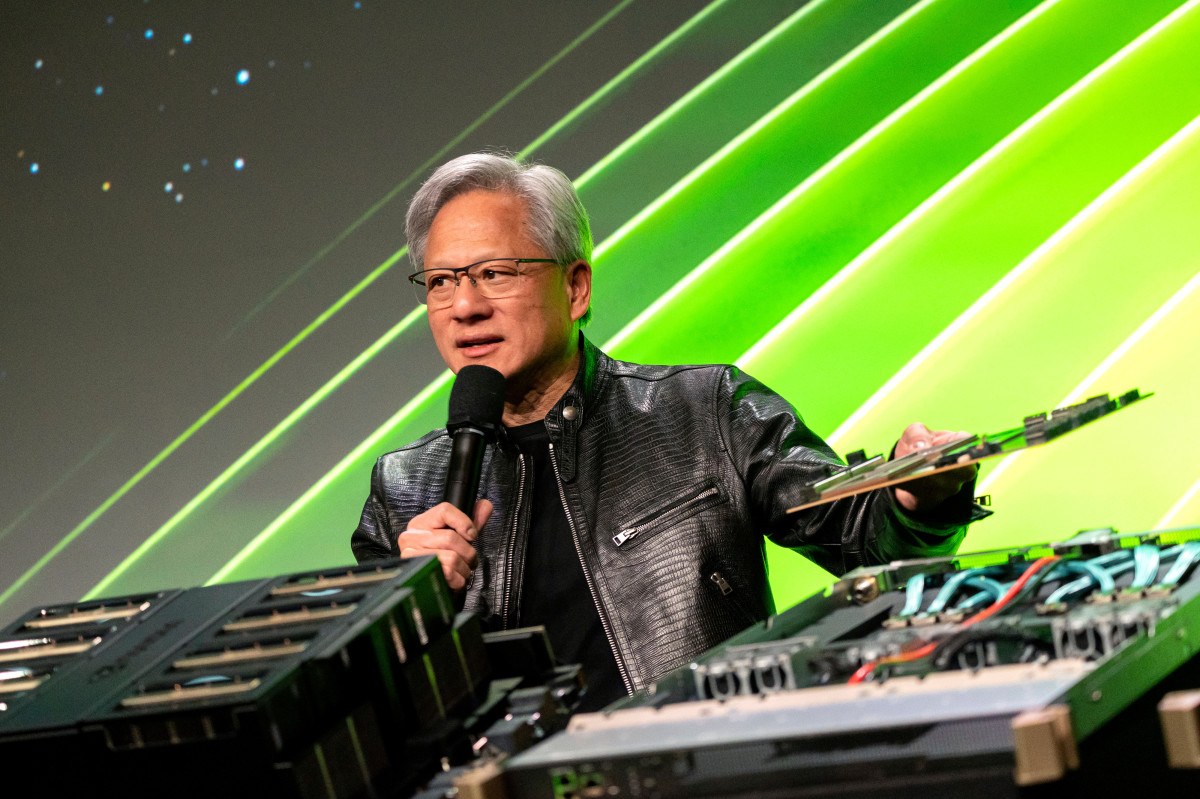

Nvidia is the leading supplier of graphics processing units, which are essential for artificial intelligence. Its stock surged 171% last year and nearly 239% in 2023, as investors bet on its dominant role in the AI boom.

While Nvidia’s growth remains strong compared to other tech giants, its pace is slowing.

The company expects to report about $43 billion in first-quarter revenue, a 65% increase from a year earlier. That is a sharp slowdown from the 262% growth in the same period last year.

In February, Nvidia posted better-than-expected fourth-quarter results, but its stock dropped 8.5% after reporting a narrowed gross margin. The company attributed this to newer data-center products that were more complicated and costly.

Nvidia stock continued to struggle in March and early April, dragged down by tariff uncertainties. However, the stock has rallied over the past month.

Just ahead of its next earnings release, Nvidia is benefiting from the U.S. decision to scrap the Biden administration’s AI diffusion rules, which would have restricted the sale of its chips to certain countries.

Nvidia also became a key topic during President Donald Trump’s trip to Saudi Arabia in May. The company said it will supply several hundred thousand AI processors to Humain, an AI startup backed by the Saudi sovereign wealth fund, over five years.

Related: Nvidia CEO shares blunt message on China chip sales ban

The AI Diffusion Rule, introduced in January 2025, was designed to restrict advanced AI chip exports to countries such as China. But it drew criticism from companies including Microsoft (MSFT) and Oracle (ORCL) , which argued the limits would hurt U.S. businesses in markets like India and Switzerland while doing little to block China.

Although the rule has been scrapped, the U.S. is still tightening export controls to curb China’s access to advanced AI chips.

In April, Nvidia said it would take a $5.5 billion charge to export its H20 chips to China and other countries, citing higher costs under new export rules set by Trump. The company also said it now needs a government license to ship the chips.

China remains a key market for Nvidia, making up 13% of its sales in the past financial year. To adapt to the new rules, Nvidia plans to launch another cheaper AI chip for the Chinese market, with production expected to begin as early as September, according to Reuters.

Latest News

- Franco-Nevada Price Target Raised to $195 by H.C. Wainwright After Royalty Deal

- Weyerhaeuser Stock Rated Hold by Argus as Housing Sector Remains Weak

- Needham Sees Upside in Rocket Lab Post-Geost Deal, Hikes Price Target

- Jefferies Trims Sunrun Price Target Amid IRA Uncertainty

- Benchmark Maintains Buy Rating on Ooma, Cites AirDial as Key Growth Catalyst

- Analyst Report: NVIDIA Corp