Medora Lee, USA TODAY

4 min read

U.S. stocks closed higher after a report showed a surprisingly large number of job openings in April and investors awaited a meeting between President Donald Trump and Chinese leader Xi Jinping.

Earlier in the week, the White House said the two leaders would talk, sparking hopes that they could reach a trade agreement. Trump had accused China of violating an agreement reached in Switzerland last month to roll back tariffs and trade restrictions. Beijing said it would safeguard its interests and the accusation was baseless.

Meanwhile, the Job Openings and Labor Turnover Survey (JOLTS) showed available jobs in April totaled nearly 7.4 million, an increase of 191,000 from March and higher than the 7.1 million consensus.

"The higher-than-expected job openings number this morning is a good sign for the economy, as many were worried that the tariff uncertainty was weighing too heavily on businesses," said Chris Zaccarelli, chief investment officer for Northlight Asset Management. "To the extent that they felt confident to hire and expand, shows that businesses are looking past the tariff issues for now and that should give a lift to the market."

The blue-chip Dow closed up 0.51%, or 214.16 points, to 42,519.64, the broad S&P 500 index gained 0.58%, or 34.43 points, to 5,970.37 and the tech-heavy Nasdaq rose 0.81%, or 156.34 points, to 19,398.96. The benchmark 10-year yield fell to 4.452%.

Factory orders, or new orders for manufactured goods, also rose 0.7% in April, in line with expectations and matching the increase in March. It was the third consecutive monthly increase.

The positive economic data overshadowed an earlier warning from the Organization for Economic Co-operation and Development. The OECD cut its U.S. growth outlook to 1.6%, down from 2.2% and urged more countries to strike trade deals to avoid an even sharper slowdown.

The U.S. is drafting letters asking countries to present their best trade offers by June 4.

More: Long-term unemployment hits 2-year high as hiring slows amid economic uncertainty

Stocks to watch include:

-

Constellation Energy shares added 1.42% after Meta Platforms inked a deal with the power company to buy the power generation of an Illinois nuclear plant for 20 years.

-

Joby Aviation shares jumped 7.07% after the company said it entered a memorandum of understanding to explore opportunities to enter the Saudi Arabia market.

-

Telehealth platform Hims & Hers Health said it will acquire European counterpart Zava. Shares slipped 3.59%.

-

Signet Jewelers' earnings in the first three months of its fiscal year topped analysts' estimates. It also raised its annual profit outlook and lifted the low end of its sales guidance. Shares rallied 12.37%.

-

Ford said it saw a 16% sales increase in May, marking the third consecutive year-over-over, double-digit sales increase for the automaker. Shares gained 2.1%.

-

EchoStar said it won't make about $183 million in cash interest payments on a series of Dish’s notes. The non-payment was made in light of recent uncertainty raised by the Federal Communications Commission, it said. Shares fell more than 11%.

-

Chinese electric vehicle maker Nio reported a wider-than-expected quarterly loss. Shares renbounded and were last up fractionally.

-

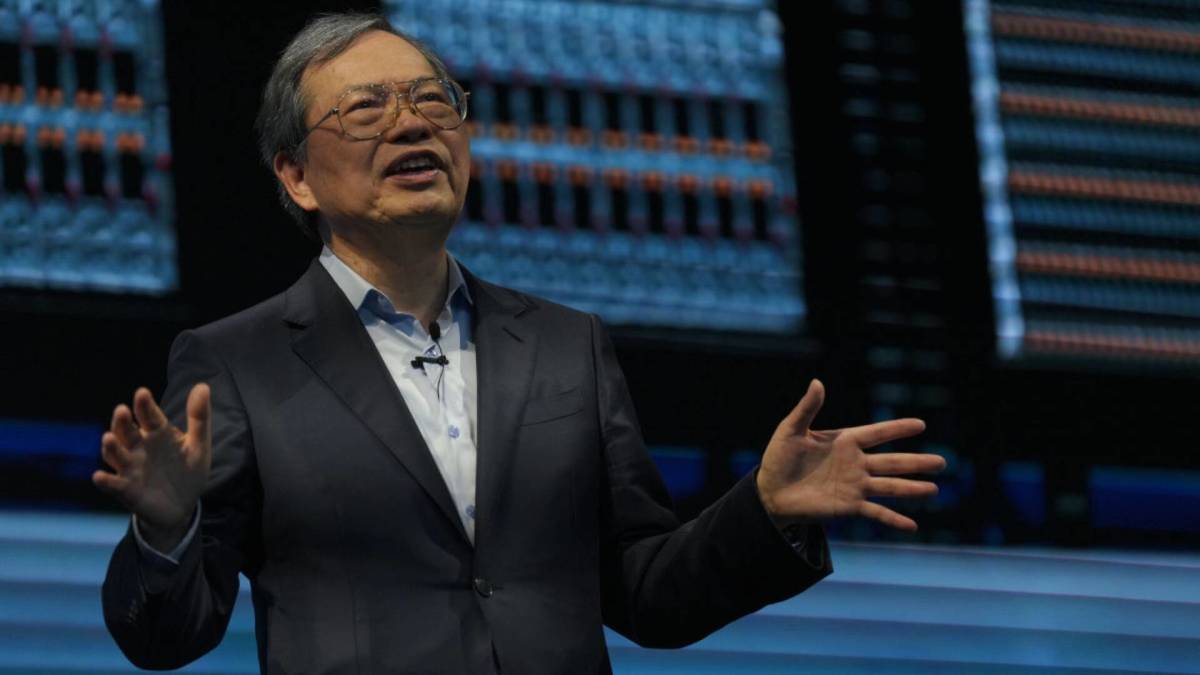

TSMC will only feel a limited impact from tariffs because the tariffs are typically paid for by importers, Chief Executive C.C. Wei said. He forecast revenue and earnings to hit new highs this year. Shares rose 1.42%.

-

Parsons cuts its annual revenue outlook due to uncertainty from the State Department's plan to restructure. Shares rose 6.98%.

-

Dollar General raised its annual sales outlook, based on the assumption current tariffs rates would remain until mid-August The discount retailer's shares gained 15.85%.

-

Pegasystem raised its full-year outlook above analysts' forecasts. Shares added 3.16%.

-

Credo Technology's results in the last three months of its fiscal year beat analysts' forecasts. Shares jumped 14.8%.