4 Big Mistakes Investors Make When the Market Is Dropping — And How To Avoid Them

Over the long run, the stock market moves based on earnings. But over the short run, it’s a much more emotional mechanism.

Be Aware: Making This Common Investing Mistake? Experts Share the Easy (but Urgent) Fix

Try This: 7 Things You'll Be Happy You Downsized in Retirement

When markets race higher, many investors chase prices as they become more confident. But when the market sells off, fear is often the dominant emotion. In that type of environment, it’s easy to make bad decisions that lead to poor investment results.

The key to success is keeping emotion out of the equation, and that can be easier said than done. But forewarned is forearmed. Here are some of the most common mistakes that investors make when markets are falling and steps you can take to avoid making them.

It can be hard even for the bravest investors to hold on to their investments when they are down 20%, 30% or even more. But corrections and bear markets are a natural and regular part of investing.

On average, a correction of 10% or more occurs about once per year, while bear markets, defined by a drop of 20% or more, happen about every four years. But here’s the thing — no matter how far the market has fallen in the past, it has always gone on to make new highs.

If you panic and sell everything you own when the market is down, you will miss the inevitable bounce-back. In fact, historically speaking, the biggest market rallies typically occur during or after bear markets, according to CBS News.

For You: How To Get a 10% Return on Investment (ROI): 10 Proven Ways

Blindly selling everything you own when the market is down is a sure-fire way to miss some of the biggest gains the market has to offer.

Getting back in at the exact market low is highly unlikely, so it’s usually best to hold on and ride out the selloff until the bull market returns.

While blindly selling all of your stocks during a downturn is a mistake, not selling the right ones can be an even worse choice. Although the overall market has always recovered from a bear market, the same cannot be said for individual stocks.

If some of your stocks are down because of their own fundamental reasons rather than general market malaise, they may deserve to be sold, as they may not come back.

When stocks are down, do your research and find out why. If earnings are slowing, management is ineffective or trends are working against a company, it may be time to sell them, even if they are down.

One of the best ways to invest for the long run is to set up automatic transfers from your bank account to your investment account(s). But some investors can feel like they’re throwing money away when the market goes down every month and their automated contributions immediately lose money.

Latest News

- Health Net and Centene Corporation (CNC) Commit Over $7.2 Million to Boost Healthcare Access Through Mobile Clinics in California

- Morgan Stanley Lifts Performance Food Group Company (PFGC) Stock Target to $93

- Silexion Therapeutics Corp (SLXN)’s RNAi Therapy Blocks 90% of Colorectal Tumors

- Candel Therapeutics, Inc. (CADL)’s CAN-2409 Advances with FDA RMAT Status for Localized Prostate Cancer

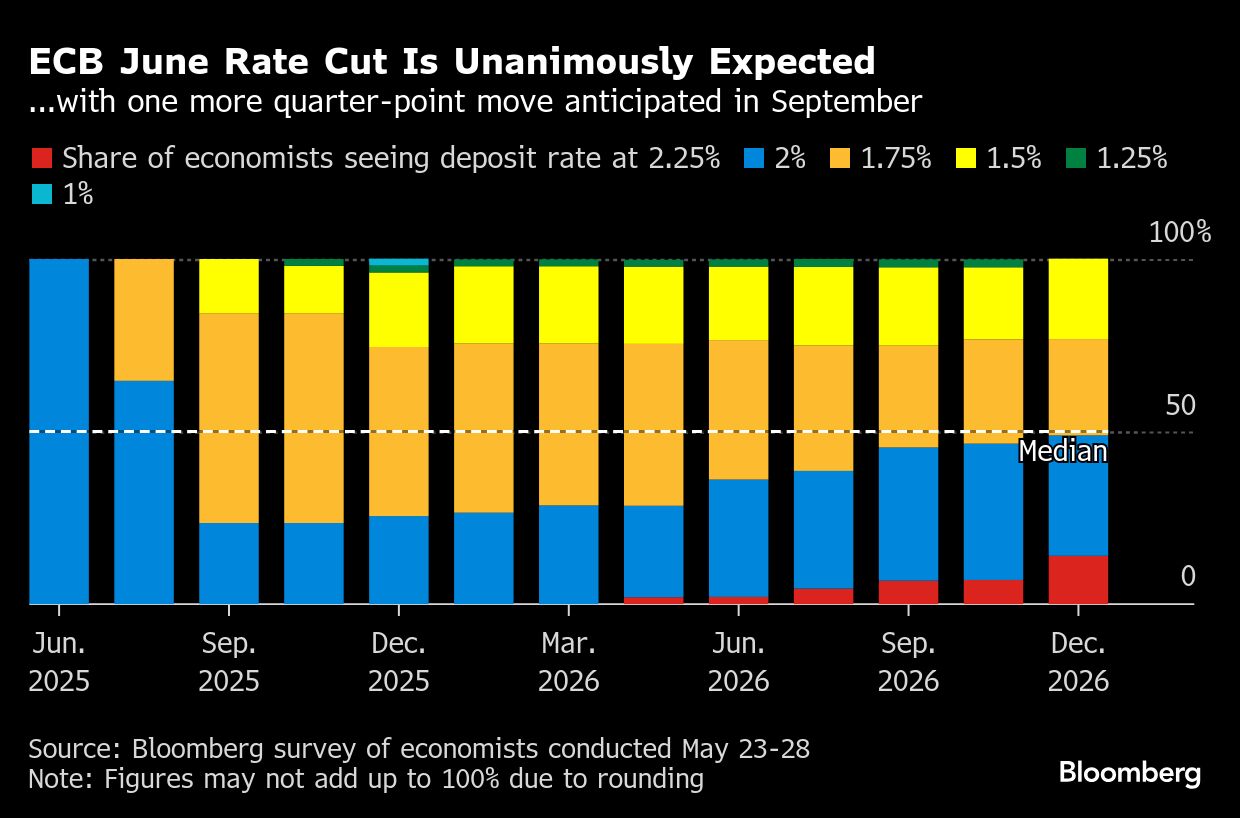

- Economists Warn ECB to Avoid Delaying Over Last Two Rate Cuts

- Cytek Biosciences, Inc. (CTKB) Elevates Cell Analysis with New Aurora Evo System