Bram Berkowitz, The Motley Fool

5 min read

In This Article:

-

Tesla and BYD are two of the largest players in the electric vehicle space.

-

BYD has outperformed Tesla in China lately.

-

However, investors seem more interested in Tesla's future initiatives than its EV business right now.

Electric vehicle (EV) companies like Tesla (NASDAQ: TSLA) and BYD (OTC: BYDDY) have captivated the minds of investors everywhere, as many view EVs as a viable new transportation option in a world that badly needs to reduce carbon emissions. In Tesla's case, investors are also betting heavily on future innovations in tech and artificial intelligence (AI) that they believe will significantly increase shareholder value in the coming years.

While both companies could have significant upside, Tesla and BYD are at different stages in their journeys, and each is prioritizing different initiatives within their businesses. Let's take a look at which stock is the better buy right now.

Tesla has long been a leader in the EV space and is credited with commercializing EVs. CEO Elon Musk is widely seen as an innovator, having helped launch multiple groundbreaking and successful companies. However, ever since Musk got involved with politics and the Department of Government Efficiency (DOGE), his brand has seemingly alienated many, including current and potential Tesla customers. Increased competition in the EV space also seems to be taking market share from Tesla.

In the first quarter of 2025, Tesla reported 337,000 vehicle deliveries, the lowest amount seen in over two years. Reports about Tesla sales in the second quarter of the year haven't improved either. Wells Fargo analyst Colin Langan recently said in a research note that he's expecting the weakness to continue. Langan said deliveries fell roughly 23% in May on a year-over-year basis and were down 21% on a quarter-to-date basis. Langan reiterated a sell rating on the stock, which he said is at risk of falling 60%.

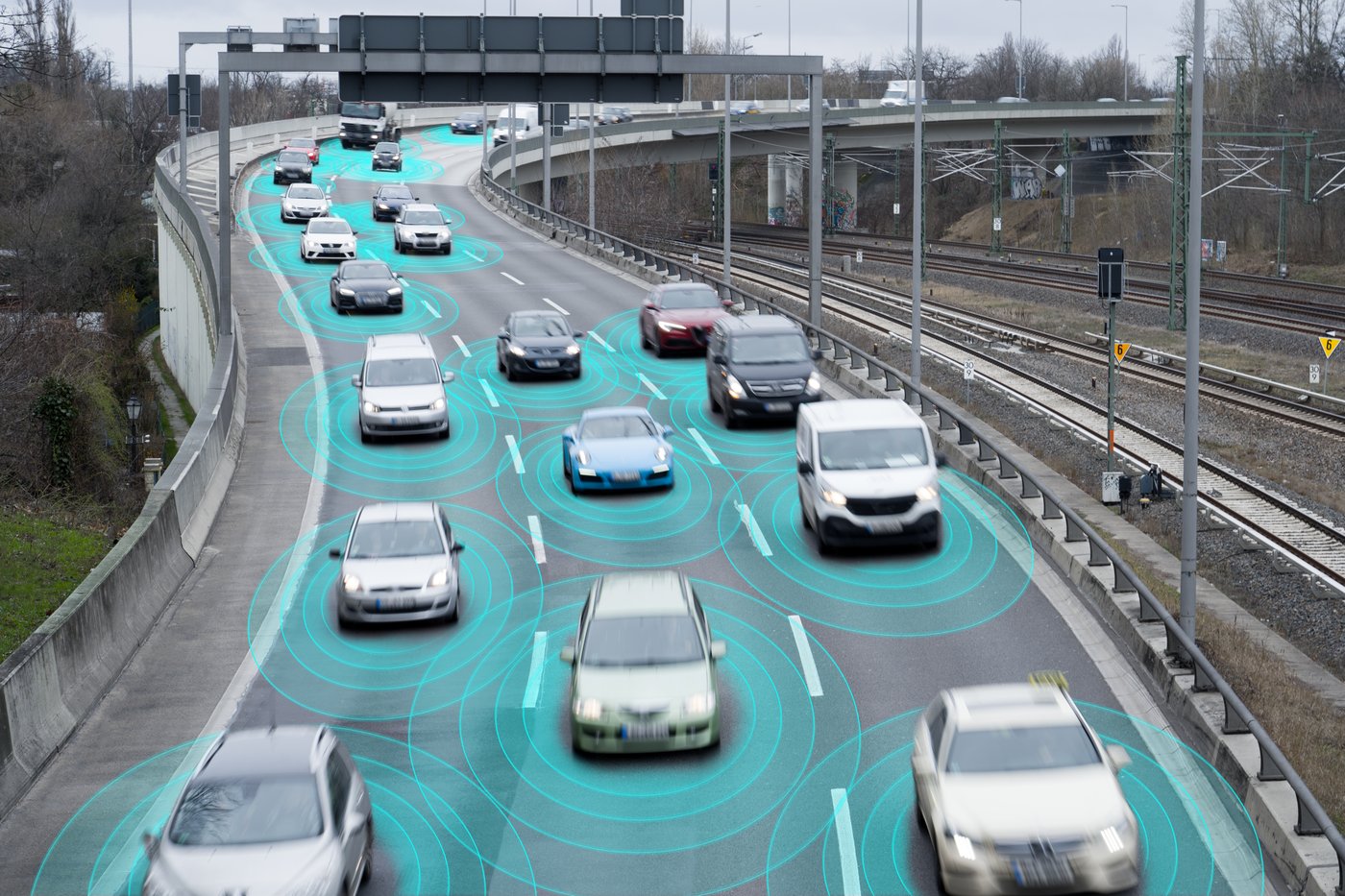

Tesla doesn't really trade on fundamentals, which is why it's become a battleground stock among analysts and investors. The bulls are banking on future initiatives such as Tesla's robotaxi service and the humanoid Optimus robots to hold the valuation up and propel Tesla's stock higher. The company recently began rolling out its first full self-driving (FSD) robotaxis in Austin, Texas, in a highly anticipated event for the company. Musk and management have previously said they think they can get 1,000 vehicles on the road by the end of this year and begin generating revenue. Musk has also said that the company expects to build 50,000 Optimus robots by the end of next year.