Nicole Spector

4 min read

In the United States, the subject of inflation is always the first eyebrow raised when it comes to times of economic unpredictability. Though the current inflation rate hovers around 2.3% and is relatively reasonable when compared to a few years ago, that doesn’t mean consumers should get too comfortable with stability.

High Yield Savings Offers

Powered by Money.com - Yahoo may earn commission from the links above.Discover More: Salary Needed To Achieve the American Dream in the 50 Largest Cities

Find Out: 10 Genius Things Warren Buffett Says To Do With Your Money

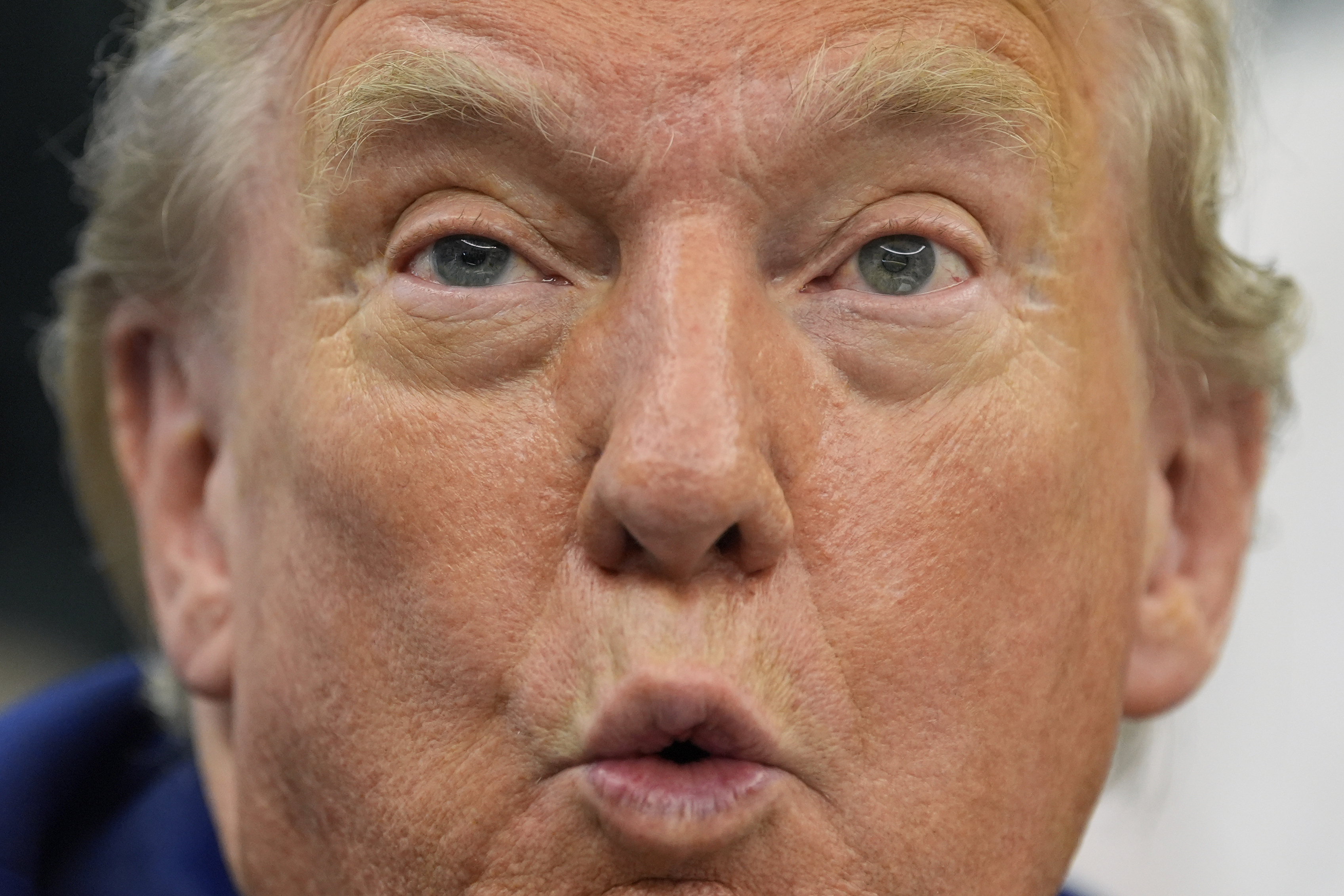

With President Trump and his White House administration putting tariffs into effect, some economists are forecasting inflation to rise slightly in the latter half of 2025. Keep in mind, this is a complex subject, and it takes a multilayered understanding of interest rates, labor markets, personal consumption expenditures and general economic conditions to really grasp just what inflation expectations to have.

So, to help make the matter more digestible, GOBankingRates consulted experts to weigh in with bite-sized insights on the future of inflation.

To gain insight into where inflation data may be headed, it’s useful to understand the current stance of American consumers and the Federal Reserve Bank’s inflation target.

According to Ed Mahaffy, certified financial planner (CFP), president and senior portfolio manager at ClientFirst Wealth Management, inflation has fallen dramatically from its previous high of over 9% to its current stance of 2.8%.

“The CPI over-weights the price of housing, more than any other developed nation by a long shot, comprising over 30% of the index,” Mahaffy said. “Even if the CPI falls from here by another point or so, do not expect your cost of living to fall in tandem.”

Read Next: Here’s the Minimum Salary Required To Be Considered Upper-Middle Class in 2025

The Trump administration has taken some big swings when it comes to global trade and levying tariffs on imported goods. Many analysts say there could be a direct correlation between these mandates and higher prices for consumers and businesses alike. Because of this, for example, economists from Morgan Stanley Research expect inflation to rise to 2.5% (excluding food and energy costs, which are predicted to reach 2.7%).

The sector that may be the most difficult to recover from high inflation is housing.

“It is likely we will see incremental gains on the inflation target from other sectors, but with housing still in tight supply and building starts being low this year, the shelter cost component faces headwinds,” said Dave Koch, managing director of advisory services at Abrigo.