Ricardo Pillai

3 min read

In This Article:

We came across a bullish thesis on Burford Capital Limited (BUR) on Substack by Coughlin Capital. In this article, we will summarize the bulls’ thesis on BUR. Burford Capital Limited (BUR)'s share was trading at $14.28 as of May 12th. BUR’s trailing and forward P/E were 15.19 and 9.68 respectively according to Yahoo Finance.

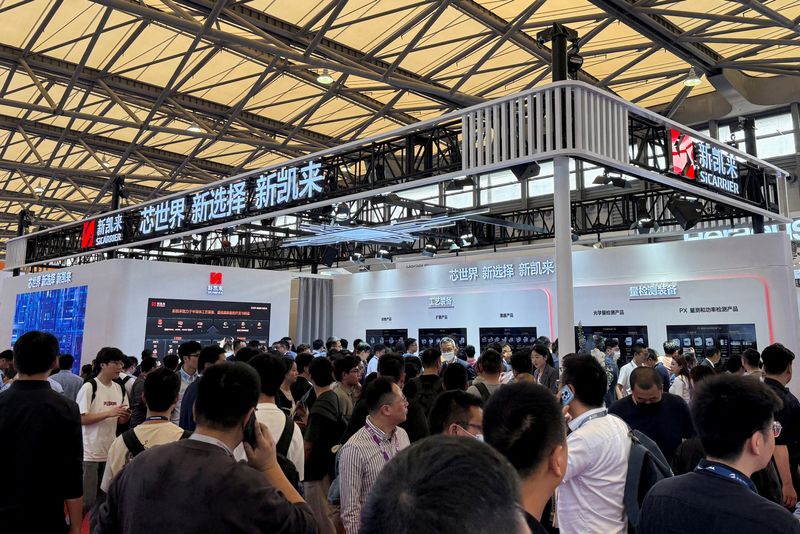

An attorney reviewing a case on a digital tablet while standing in a courtroom.

Burford Capital, founded in 2009 by attorneys Christopher Bogart and Jonathan Molot, has established itself as a global leader in the burgeoning legal finance industry, growing from a $130 million fund to managing a $7.2 billion portfolio. The company operates as an investment bank for legal claims, financing lawsuits in exchange for a share of the eventual recovery. This model addresses the disconnect between corporations seeking outcome-based legal billing and law firms preferring hourly fees. With over $11 billion in total commitments and inquiries from 94 of the 100 largest U.S. law firms, Burford's client base includes many of the world’s largest corporations and law firms. Litigation finance offers uncorrelated returns, with Burford’s concluded cases generating an average 87% return on invested capital and a 26% IRR, most of which settle before trial.

Burford operates through two key segments: Principal Finance, which deploys its own capital into legal investments, and Asset Management, where it manages roughly $2 billion in external funds. This dual structure balances volatile, high-upside litigation investments with stable fee income. The company’s investment outcomes are positively skewed—13% of cases have generated over 200% returns, while around 14% have resulted in losses. Because case durations average 2.6 years and outcomes are binary, Burford’s financials are inherently "lumpy," but long-term performance is compelling. Central to Burford’s edge is its proprietary data and deep underwriting capability, supported by 47 lawyers across seven jurisdictions and robust internal modeling. Each investment undergoes detailed due diligence with privileged client access, a significant barrier to entry.

A notable highlight is Burford’s litigation against Argentina over the nationalization of YPF, which represents around 40% of its capital provision assets. In September 2023, Burford won a $16.1 billion judgment, though the outcome remains pending appeal. Despite the concentration risk, management sees this as a potential “ten-figure” recovery. Beyond litigation funding, Burford is expanding into claim monetization and exploring adjacent legal markets such as law firm equity and legal technology, broadening its addressable market. Its structure—investing primarily from its own balance sheet with modest leverage—allows for internal compounding of returns, diverging from typical fund-driven models. While the business remains complex and sometimes misunderstood by the market, Burford’s long-term outlook is attractive. With strong fundamentals, a scalable model, and leadership still deeply aligned with shareholders, the company is well-positioned to capture growth in a legal services industry worth hundreds of billions, offering a unique, high-upside opportunity as litigation finance continues to gain mainstream acceptance.