Fed loosens the shackles on Wells Fargo nearly a decade after fake accounts scandal

The Federal Reserve is loosening a major restriction on Wells Fargo (WFC) that was put in place following a fake accounts scandal nearly a decade ago, and the fourth-largest US bank will no longer have to operate under a $1.95 trillion asset cap.

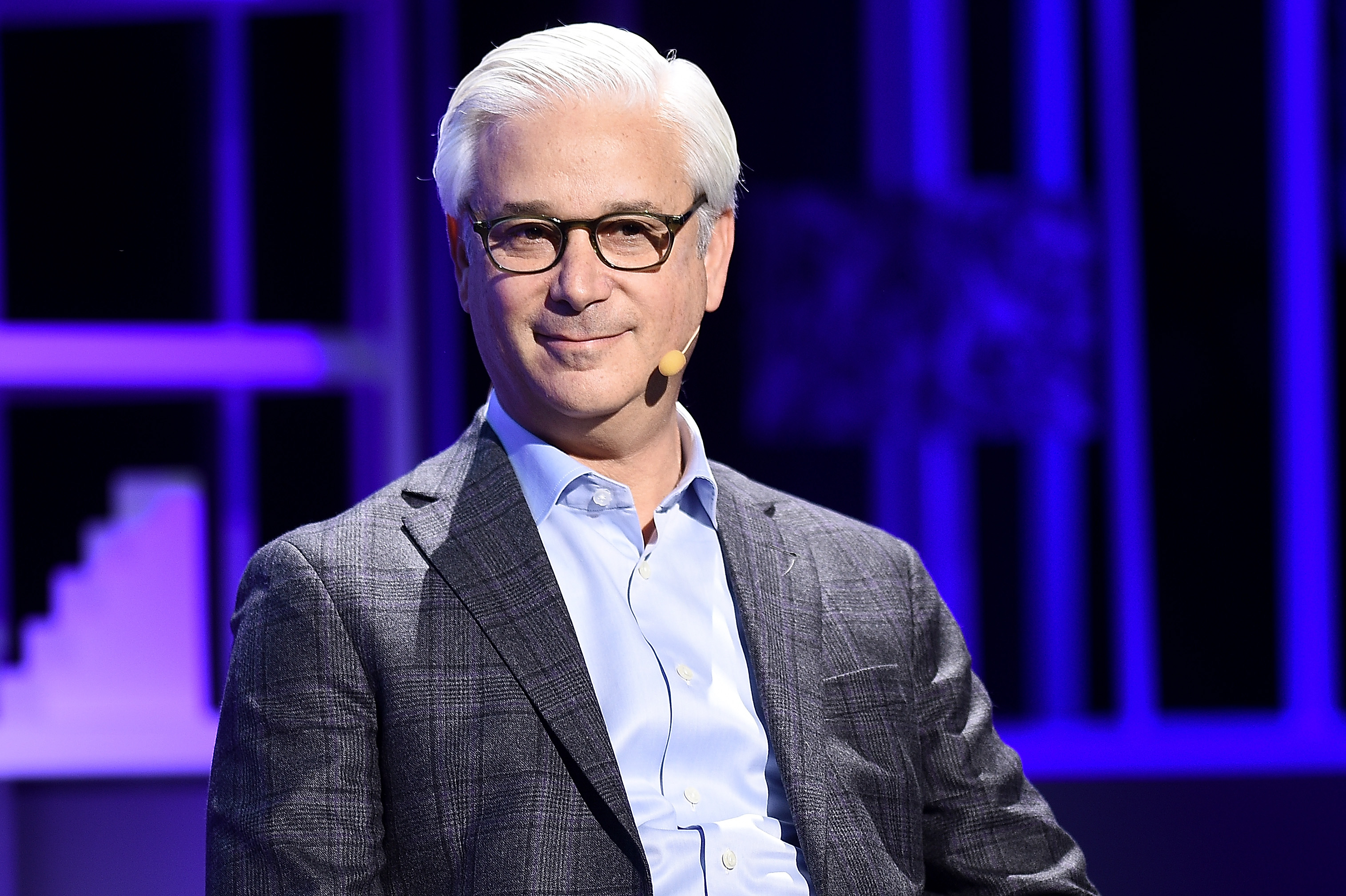

The move was a victory for CEO Charles Scharf, who said when he took over the top job in 2019 that his "first priority" was to clean up the messes left by his predecessors.

“The Federal Reserve’s decision to lift the asset cap marks a pivotal milestone in our journey to transform Wells Fargo," he said in a release.

Wells Fargo’s stock climbed as much as 3% in premarket trading on Wednesday. Its stock has climbed more than 50% during Scharf's tenure as CEO.

The lifting of the cap will help Scharf go on the offensive as he tries to make Wells Fargo into a major investment banking player, edging deeper into a hyper-competitive business where it lags behind Wall Street giants like Goldman Sachs (GS), JPMorgan Chase (JPM), and Morgan Stanley (MS).

Read more: The 10 best national and super regional banks of 2025

The Fed imposed the broad restriction as part of a wider consent order in 2018, citing "widespread consumer abuses" at Wells Fargo after federal investigations revealed a wide-ranging sales practice scandal in 2016. It couldn't go past the $1.95 trillion in assets it had at the end of 2017 unless regulators said so.

"The removal of the growth restriction reflects the substantial progress the bank has made in addressing its deficiencies and that the bank has fulfilled the conditions required for removal of the growth restriction," the Federal Reserve said in a press release.

The other provisions in the 2018 enforcement action still remain in place until the bank satisfies the requirements for their termination.

Scharf has now ticked off 13 consent orders that regulators had in place when he became boss, seven of which have been lifted this year.

"We are a different and far stronger company today because of the work we’ve done," he added in a release. "We are excited to continue to move forward with plans to further increase returns and growth in a deliberate manner supported by the processes and cultural changes we have made.”

In more recent months, Scharf and the rest of Wells Fargo's current management team have tried to play down any expectation for an immediate earnings boost once the asset cap is removed.

"I would just caution that when it does happen, it’s not this kind of light switch moment,” CFO Mike Santomassimo said while speaking at a UBS conference as far back as March 2024.

Latest News

- Amazon to invest $10bn in North Carolina data centres

- Apple Inc. (AAPL) to Show Off Incremental AI at WWDC, Analysts Temper Hype

- When will mortgage rates go down to 5%?

- Market’s New Hope for Apple (AAPL) ‘Super Cycle’ After AI Dissappointment: iPhone Air

- I Asked ChatGPT To Explain How To Make Money Without Working: Here’s What It Said

- How often do mortgage rates change?