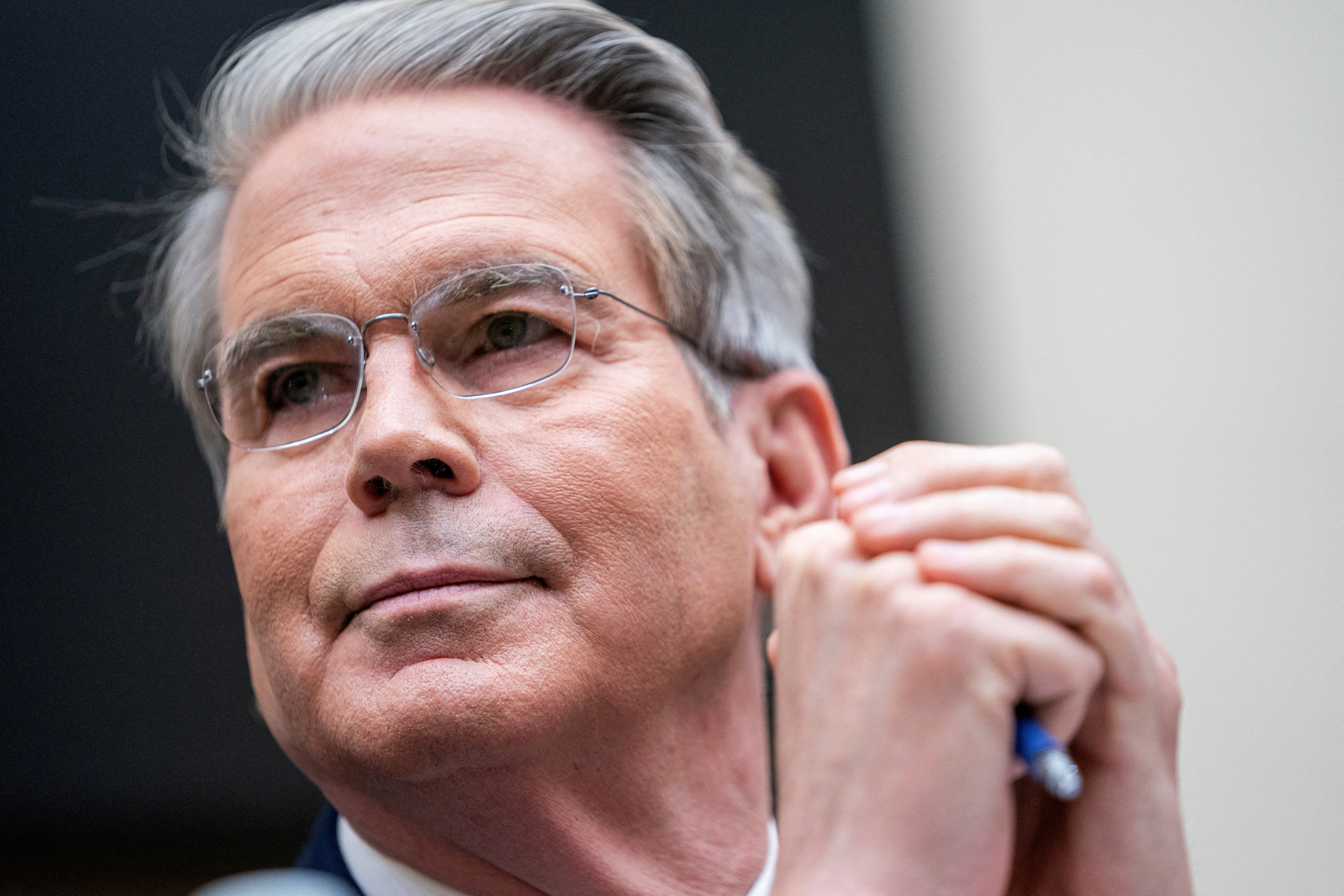

Why Scott Bessent wants to make it easier for banks to own Treasurys

Treasury Secretary Scott Bessent says US regulators are close to easing a key regulatory requirement for banks that the Trump administration hopes will inject more liquidity into the Treasury market, boost lending, and reduce upward pressure on long-term borrowing rates.

The move would mark a retreat from a key change made following the 2008 financial crisis when regulators imposed a series of new requirements designed to protect the banking system against future threats to its stability.

One of those requirements that Bessent wants to adjust was the so-called supplemental leverage ratio (SLR), a rule that requires big banks to maintain a preset buffer against their total portfolio of loans and debt. That pile includes large holdings of US Treasurys.

Bankers maintain that asking them to hold capital when they trade against their Treasury investments discourages them from acting as intermediaries in the financial markets, which can contribute to stress when markets become volatile.

The question of liquidity in the roughly $30 trillion market for US Treasurys has taken on new urgency following troubles in 2020 during the COVID-19 pandemic and a recent climb in long-term Treasury yields driven by growing concerns over the trajectory of US debt.

Some market watchers say investors' confidence in US debt has been shaken by the nation's fiscal challenges.

JPMorgan Chase (JPM) CEO Jamie Dimon on Friday said that a crack in the bond market is "going to happen."

"I just don’t know if it’s going to be a crisis in six months or six years, and I’m hoping that we change both the trajectory of the debt and the ability of market makers to make markets," Dimon said at the Reagan National Economic Forum.

"Unfortunately, it may be that we need that to wake us up."

Banks are key buyers of US Treasurys and serve as broker-dealers in the Treasury market, helping other investors buy and trade the government bonds.

Bessent hopes a capital rule reset will allow banks to add more Treasurys to their balance sheet, thus giving the flood of supply a fresh incremental buyer. He also hopes that making things easier for banks will reduce upward pressure on long-term Treasury yields — another key goal for the new administration.

"The SLR can risk becoming a binding constraint, instead of a backstop," Bessent said in a speech on March 6 before the Economic Club of New York. "The result is that the safest asset in the country, U.S. Treasuries, are not treated as such when the leverage restriction is applied."

Latest News

- Cathie Wood buys $13.9 million of popular AI stock

- Jim Cramer and Wall Street Are Watching UnitedHealth Group (UNH)

- Jim Cramer and Wall Street Are Bullish on Capital One Financial Corporation (NYSE:COF)

- Jim Cramer and Wall Street Are Bullish on Fair Isaac Corporation (FICO)

- KKR raises conditional offer for German IT services firm Datagroup

- Is Duolingo Stock a Buy in the Second Half of 2025?