Dollar holds steady as Middle East keeps investors jittery

By Ankur Banerjee and Lucy Raitano

LONDON (Reuters) -The dollar edged up on Thursday as the threat of a broader Middle East conflict loomed over markets, while a raft of rate decisions in Europe highlighted the difficulty central bankers have in dealing with heightened uncertainty.

Rapidly rising geopolitical tensions have boosted the dollar, which has reclaimed its safe-haven status lately.

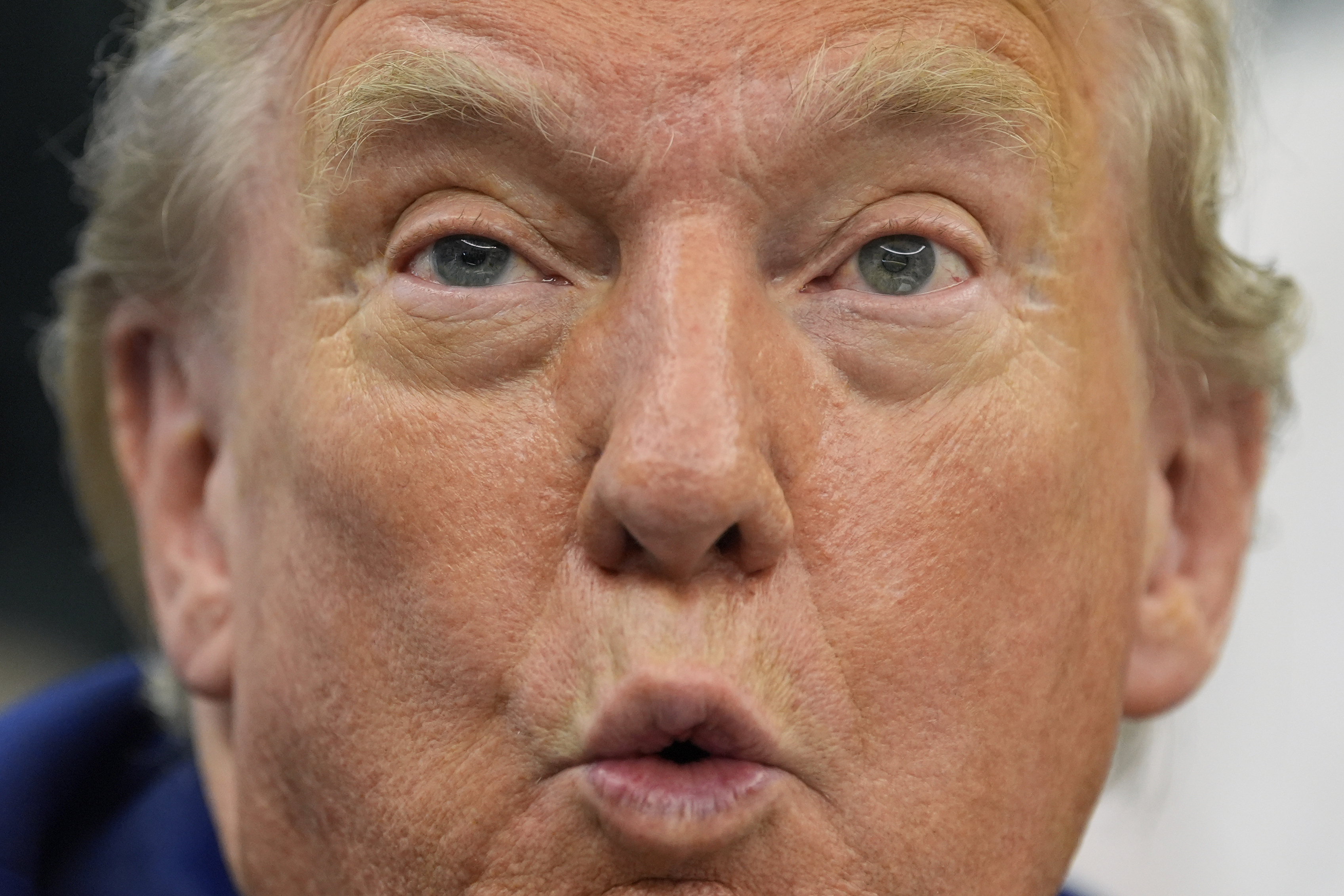

Iran and Israel carried out further air attacks on Thursday, with the conflict entering its seventh day. Concerns over potential U.S. involvement have also grown, as President Donald Trump kept the world guessing about whether the United States will join Israel's bombardment of Iranian nuclear sites.

The Federal Reserve left rates steady on Wednesday. The Bank of England also left rates unchanged on Thursday, citing elevated global uncertainty and persistent inflation as concerns for the economic outlook. The pound fell initially, but later recouped most of those losses.

The Swiss franc, meanwhile, was stronger against the dollar following an expected rate cut from the Swiss National Bank.

But the surprise came from the Norges Bank, which delivered a 25 bps rate cut, while markets had expected the Norwegian central bank to hold rates.

The dollar and the euro both rallied by 1% against the Norwegian crown. The crown is still one of the top-performing major currencies against the dollar this year, with a gain of around 11%.

Meanwhile, the euro dipped 0.1% to $1.1473. The dollar rose 0.2% against the yen to 145.56.

The dollar index, which measures the currency against six others, was flat at 98.9 and was set for about a 0.8% gain for the week, its strongest weekly performance since late February.

ING strategist Francesco Pesole said the fact that geopolitical risks and high oil prices were not "U.S.-induced risks," unlike the risks to U.S. government finances from Trump's tax cut plans or his tariff policies, the dollar could once again take on its role as a safe haven.

"The dollar is still in a more favourable spot than the energy-dependent safe-haven alternatives (like the euro) in this environment," he said.

U.S. markets were closed on Thursday for the federal Juneteenth holiday, which could mean liquidity is lower.

FED STANDS PAT

In a widely expected move, the Fed held rates steady, with policymakers signalling they still expect to cut rates by half a percentage point this year, although not all of them agreed on a need for rate cuts.

Fed Chair Jerome Powell said goods price inflation will pick up over the course of the summer as Trump's tariffs start to impact consumers.

Latest News

- X app code points to a physical card coming to X Money

- Meet QXO, the Upstart Building Materials Stock That May Battle Home Depot for GMS

- Daily Spotlight: Fed Fine with Level of Rates

- Coinbase, Circle, SRM lead stock rally as Trump cheers GENIUS Act in another dream week for crypto

- Week’s Best: Trump Accounts for Kids Have Strings Attached

- Leasing lays the foundation as UK construction sector feels the strain