Cathie Wood buys $13.9 million of popular AI stock

Cathie Wood buys $13.9 million of popular AI stock originally appeared on TheStreet.

Cathie Wood, head of Ark Investment Management, often buys her favorite tech stocks when prices dip.

This is what she did in late May, adding shares of a popular AI company after a pullback.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💵

Wood’s funds saw a brief bump after Trump won the presidency last November, but that momentum didn’t go far. Her flagship Ark Innovation ETF (ARKK) underperformed the S&P 500 index amid broader market volatility this year.

Year-to-date, ARKK is down 2.15%, while the S&P 500 index is up 0.51%.

Wood gained a remarkable 153% in 2020, which helped build her reputation and attract loyal investors. Still, her long-term performance has made many others skeptical of her aggressive style.

As of May 30, Ark Innovation ETF, with $5 billion under management, has delivered a five-year annualized return of negative 1.66%. In comparison, the S&P 500 has an annualized return of 15.94% over the same period.

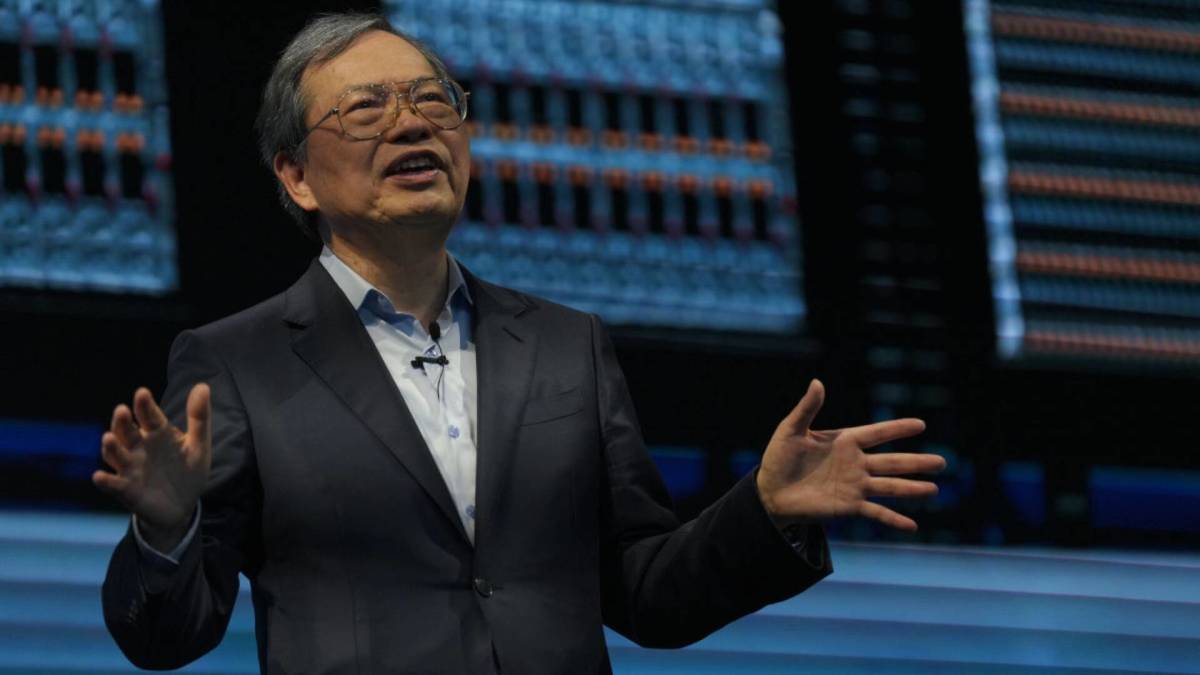

Cathie Wood's flagship Ark Innovation ETF has seen $2.02 billion in net outflows over the past year through May 29.</em>Image source: Marco Bello/Stringer/Getty Images" height="540" loading="eager" src="data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///ywAAAAAAQABAAACAUwAOw==" width="960">

Wood’s investment strategy is straightforward: Her Ark ETFs typically buy shares in emerging high-tech companies in fields such as artificial intelligence, blockchain, biomedical technology, and robotics.

Wood says these companies have the potential to reshape industries, but their volatility leads to major fluctuations in Ark funds' values.

Related: Cathie Wood's net worth: The Ark Invest CEO's wealth & income

The Ark Innovation ETF wiped out $7 billion in investor wealth over the 10 years ending in 2024, according to an analysis by Morningstar’s analyst Amy Arnott. That made it the third-biggest wealth destroyer among mutual funds and ETFs in Arnott’s ranking.

Wood recently said the U.S. is coming out of a three-year “rolling recession” and heading into a productivity-led recovery that could trigger a broader bull market.

In a letter to investors published last month, she dismissed recession predictions as she expects "more clarity on tariffs, taxes, regulations, and interest rates over the next three to six months."

"If the current tariff turmoil results in freer trade, as tariffs and non-tariff barriers come down in tandem with declines in other taxes, regulations, and interest rates, then real GDP growth and productivity should surprise on the high side of expectations at some point during the second half of this year," she wrote.

She also struck an optimistic tone for tech stocks.

"During the current turbulent transition in the U.S., we think consumers and businesses are likely to accelerate the shift to technologically enabled innovation platforms including artificial intelligence, robotics, energy storage, blockchain technology, and multiomics sequencing," she said.

Latest News

- Heavily shorted AI stock is rapidly climbing the Fortune 500

- US labor market easing in the face of tariff uncertainty

- Victoria's Secret says it will postpone earnings report after recent security breach

- Safehold Special Risk unveils contractors’ equipment coverage

- Dollar General Stock Takes Off After Earnings. Here’s What We Know.

- JPMorgan gives consumer banking head Lake more responsibility as incumbent leaves