Ananya Gairola

3 min read

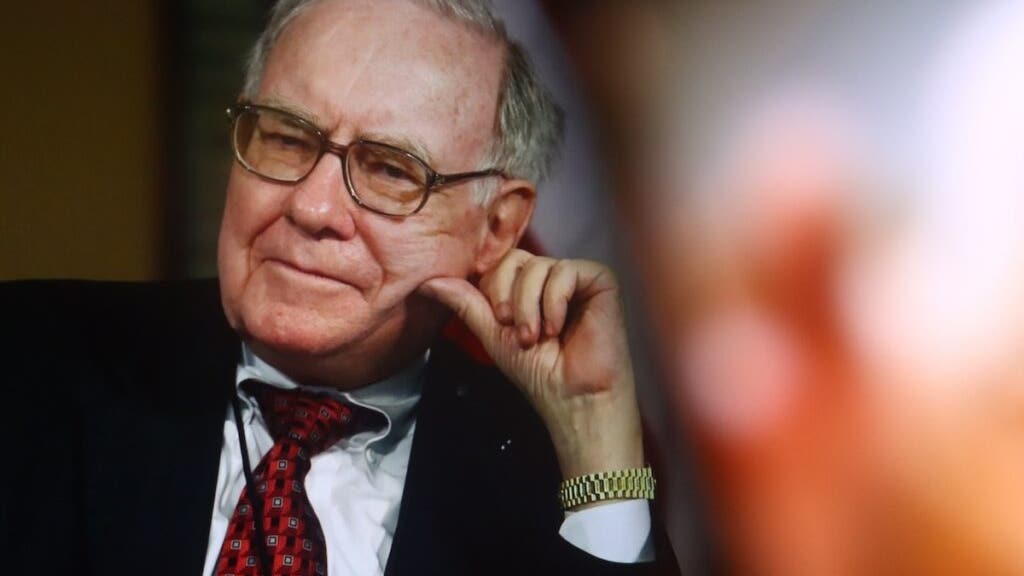

At Berkshire Hathaway's (NYSE:BRK) (NYSE:BRK) 2023 annual meeting, CEO Warren Buffett shared a rare insight into why See's Candies, a beloved West Coast confectioner owned by the conglomerate since 1972, hasn't expanded successfully beyond its core markets.

What Happened: "We have this wonderful brand that doesn't travel," Buffett said. "The mystique, the actual product, the feelings people have about some things... it's limited to given markets."

Despite See's strong economy in California and the western U.S., attempts to replicate that success elsewhere repeatedly fell short.

"We tried everything in the world to move the brand... and we always think we were right for the first week," Buffett said. "Then we find out that the magic—we can beat any other candy store pretty much—but there aren't any candy stores anymore to speak of, as the world has changed."

Trending: Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — this is your last chance to become an investor for $0.80 per share.

Buffett compared See's regional success to Dr Pepper's dominance in certain markets like Dallas–Fort Worth, noting that even national advertising and widespread awareness can't override local preferences.

"There are all kinds of crazy things in the world that consumers do," he added, pointing out that East Coast customers prefer dark chocolate, while West Coast buyers gravitate toward milk chocolate.

See Also: The team behind $6B+ in licensing deals is now building the next billion-dollar IP empire — invest early at $2.25/share.

Why It's Important: See's Candies began in 1921 when Charles See and his family opened their first shop in Los Angeles, offering chocolates based on his mother Mary See's original recipes.

The company quickly earned a reputation for quality and freshness, building a loyal customer base across California. A major turning point came in 1972 when Buffett and Charlie Munger's Berkshire Hathaway acquired See's for $25 million.

What began as a modest operation with $30 million in annual revenue and under $5 million in pretax income grew into a confectionery powerhouse, generating over $380 million in annual sales and $80 million in profits, reported Markets Insider in 2019.

Buffett's admiration for See's is also no secret. During shareholder meetings, he famously keeps a box of See's peanut brittle close by.

Read Next:

-

Hasbro, MGM, and Skechers trust this AI marketing firm — Invest before it's too late.

-

Deloitte's fastest-growing software company partners with Amazon, Walmart & Target – Many are rushing to grab 4,000 of its pre-IPO shares for just $0.30/share!