Krisztian Sandor

3 min read

In This Article:

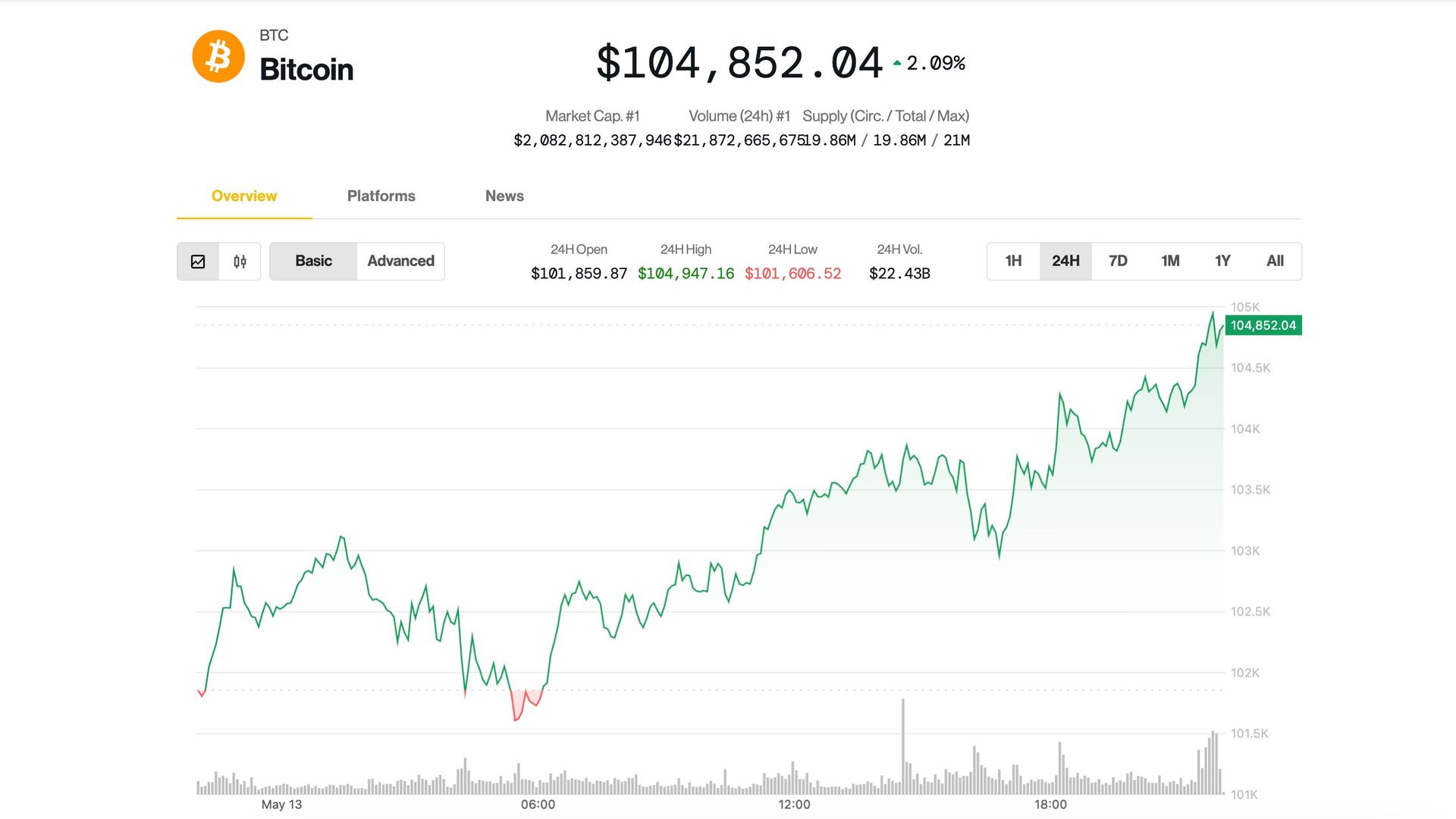

Bitcoin BTC climbed back above $104,000 on Tuesday with welcome fresh inflation data, President Trump's bullish outlook on financial markets, and Coinbase's inclusion into the S&P 500 among catalysts for the advance.

April’s Consumer Price Index (CPI) came in cooler than anticipated, which may allay pressure on the Federal Reserve anxious about inflation due to tariffs. Fed Chair Jerome Powell's scheduled speech on Thursday could provide further policy guidance.

The upbeat mood was further lifted by Donald Trump, who told attendees at the Saudi–U.S. Investment Forum in Riyadh that markets "could go a lot higher,.".

Bitcoin (BTC) nearly touched $105,000 before pulling back, at press time trading 2.4% higher over the past 24 hours at around $104,400. Most altcoins in the CoinDesk 20 Index outperformed. Ethereum's ether ETH continued its resurgence advancing over 9% to $2,700. Restaking protocol Eigenlayer's governance token EIGEN and decentralized finance (DeFi) protocol EtherFi's native token ETHFI booked more than 20-30% daily gains.

Stocks added to their recent gains, with the Nasdaq and S&P 500 up 1.6% and 0.75%, respectively, at the session close. Nasdaq-listed crypto exchange Coinbase (COIN) surged 24% during the day as the stock is set to benefit from being included in the S&P 500 index. The change could unleash $16 billion in buying pressure for shares, Jefferies forecasted.

Joel Kruger, market strategist at LMAX Group, said that the crypto market is still digesting last week's gains, but the rally has further momentum. “Currently, the market appears to be pausing for breath, yet the prevailing sentiment in recent headlines suggests this rally still has room to grow,” Kruger said.

He pointed to a rebound in global risk appetite and a growing number of institutional tailwinds. “One notable factor is the increasing mainstream adoption of cryptocurrency, as evidenced by developments in U.S. financial markets. Coinbase’s inclusion in the S&P 500 marks a historic milestone, establishing it as the first crypto-native company to join this prestigious index,” Kruger said.

He also cited improving sentiment around regulation. SEC Chair Paul Atkins has pledged to make the U.S. a hub for cryptocurrency innovation, which Kruger believes could unlock a new wave of institutional interest if followed by meaningful policy clarity.

Paul Howard, senior director at trading firm Wincent, echoed that view, saying that while altcoins are tracking the broader rally, institutional capital is likely to become more selective. “This evolving landscape appears to be laying the groundwork for increased institutional participation,” he said in a Telegram message. “The more resilient altcoin projects could benefit, while weaker ones may gradually phase out.”