Syeda Seirut Javed

2 min read

In This Article:

Silicon Motion Technology Corporation (NASDAQ:SIMO) is one of the 10 tech stocks on Wall Street’s radar right now. On June 5, B.Riley increased its price target on Silicon Motion Technology Corporation (NASDAQ:SIMO) to $90 from $75 and reaffirmed its Buy rating on the stock.

The firm pointed to the expanded Nvidia Bluefield DPU win and the upcoming Nintendo Switch 2 cycle as drivers of longer-term gains for the company. It further added that progress in the PCIe Gen5 PC and notebook market is on track, with Silicon Motion (NASDAQ:SIMO) projected to grow its market share to over 50% using its 8- and 4-channel products.

Additionally, B.Riley provided a bullish outlook on the company’s future earnings as it said that similar momentum is expected from the adoption of UFS 4.0 in smartphones. The developments could push estimated earnings per share in 2026 and 2027 to around $5.25 and $6.50, respectively.

An engineer in a lab coat tweaking a circuit board with intricate semiconductors.

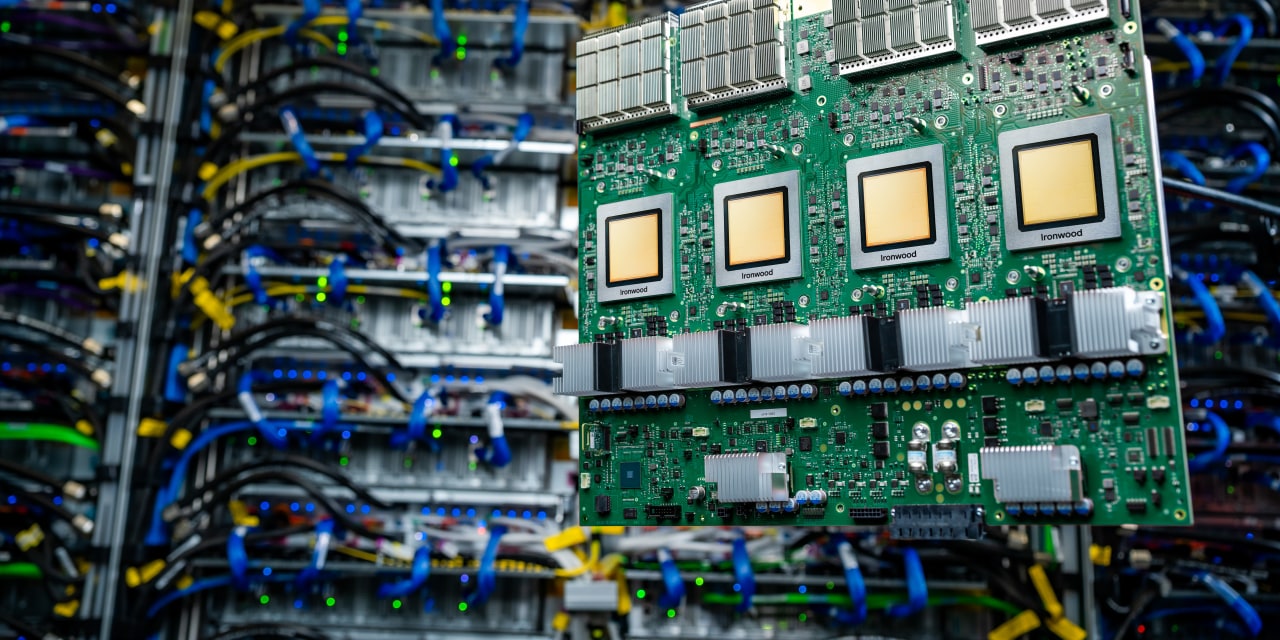

During the company’s Q1 2025 earnings call, management highlighted that Silicon Motion (NASDAQ:SIMO) has partnered with NVIDIA for over a year to qualify its MonTitan server boot storage for the BlueField-3 DPU, a platform designed to optimize AI workloads and cloud networking. Starting later this year, its boot storage will support BlueField-3, creating new revenue and growth opportunities.

Silicon Motion (NASDAQ:SIMO) designs and sells NAND flash controllers and specialized SSDs for various applications, including computing, enterprise data centers, mobile devices, and industrial uses, under multiple brand names.

While we acknowledge the potential of SIMO as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None.